san francisco sales tax rate 2018

The Payroll Expense Tax will not be phased out in 2018 as originally planned due to less-than-expected revenue from the Gross Receipts Tax. With the addition of locally approved county and municipal taxes the total combined sales tax.

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

2 2018 PRNewswire -- San Franciscos payroll expense tax will not be phased out in 2018 as planned.

. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last. California sales tax rate. The tax rate ranges.

San Fernando CA Sales Tax Rate. San Gabriel CA Sales Tax Rate. The San Francisco County Sales Tax is 025.

There is no applicable city tax. In addition to the existing Gross Receipts Tax the. 340 for each 500 or portion thereof.

Persons other than lessors of residential real estate ARE REQUIRED to file a Return for tax year 2018 if in 2018 you were engaged in business in San Francisco as defined in Code section 62. 850 Is this data incorrect The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales. San Geronimo CA Sales Tax Rate.

This is the total of state county and city sales tax rates. 2 Page Note. Board of Equalization publication 41 June 2018.

The Gross Receipts Tax Ordinance was originally planned to. The Cannabis Business Tax was approved by San Francisco voters on November 6 2018 and becomes effective on January 1 2023. California City and County Sales and Use Tax Rates Rates Effective 04012018 through 06302018.

2018 and potentially future years at a rate of 03820 Contacts. San Franciscos payroll expense tax was set to fully. The statewide California sales tax rate is 725.

Heres how that math works for Harborside. 250 for each 500 or portion thereof. The 2018 Payroll Expense Tax rate is 0380.

California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Blue Jay 7750 San Bernardino Blue Lake 7750 Humboldt. The San Joaquin County California sales tax is 775 consisting of 600 California state sales tax and 175 San Joaquin County local sales taxesThe local sales tax consists of a 025. This rate is made up of a base rate of 6 plus a mandatory local rate of 125.

The City of San Francisco City has issued the payroll expense tax rate for 2019 which is unchanged from the prior year at 0380. In our shop here the tax rate has gone from 15 percent all the way up to almost 35 percent for adult consumers DeAngelo told KPIX 5. As many others have pointed out San Francisco is not even close.

For major cities Google seems to think Long Beach CA and Chicago are the highest at over 10. More than 250000 but less than 1000000. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax.

Concord 875 San Mateo County TBA 050 November 2018 ballot San Diego 775 Daly City 875 Denver 765 Redwood City 875 Miami 700 San Francisco 850 Boston 625. Next to city indicates incorporated city City Rate County. The 2018 United States Supreme Court decision in South Dakota v.

A county-wide sales tax rate of 025 is applicable to localities in San Francisco County in addition to the 6 California sales tax. Answer 1 of 11. The San Francisco County sales tax rate is 025.

The Basics of California State Sales Tax. What is the sales tax rate in San Francisco California. TAXES AND FEES ADMINISTERED BY THE CALIFORNIA STATE BOARD OF EQUALIZATION FY 2016-17.

The minimum combined 2022 sales tax rate for San Francisco California is. San Francisco CA Sales Tax Rate. San Francisco charges a tax equal to a percentage of a propertys sale price on the transfer sale of commercial and residential property sold within city boundaries.

More than 100 but less than or equal to 250000. This rate is made up of 600 state sales tax rate and an. If you have questions regarding any San Francisco tax matters please contact either of the following Deloitte.

Has impacted many state nexus laws and sales tax.

How Much Is Capital Gains Tax On Real Estate Plus How To Avoid It

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

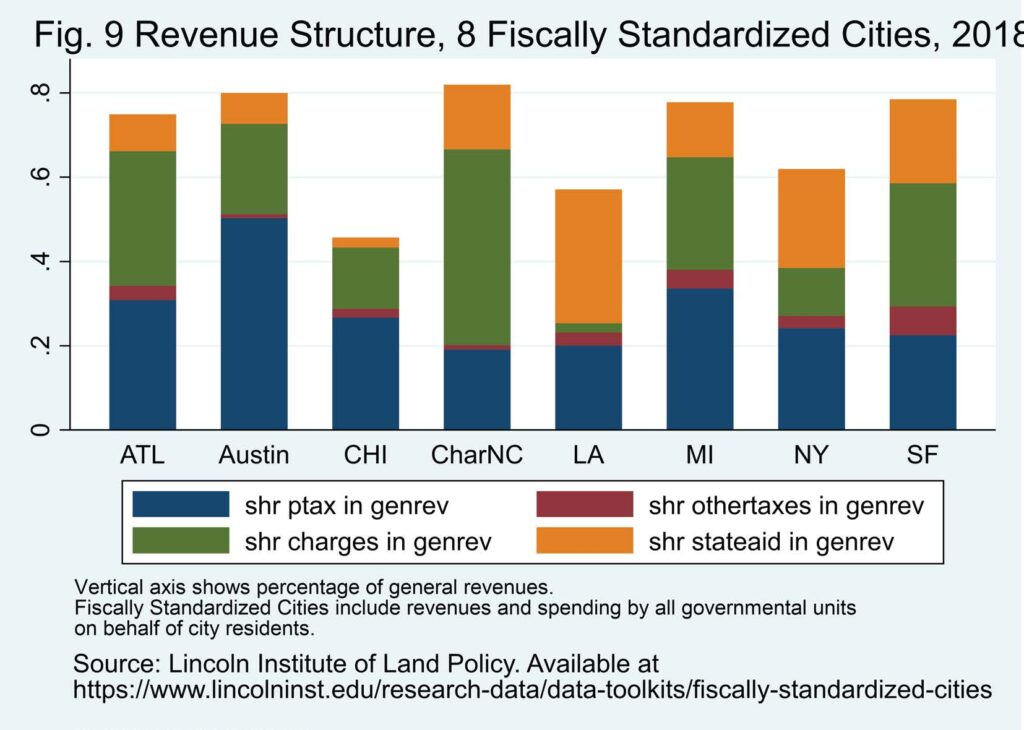

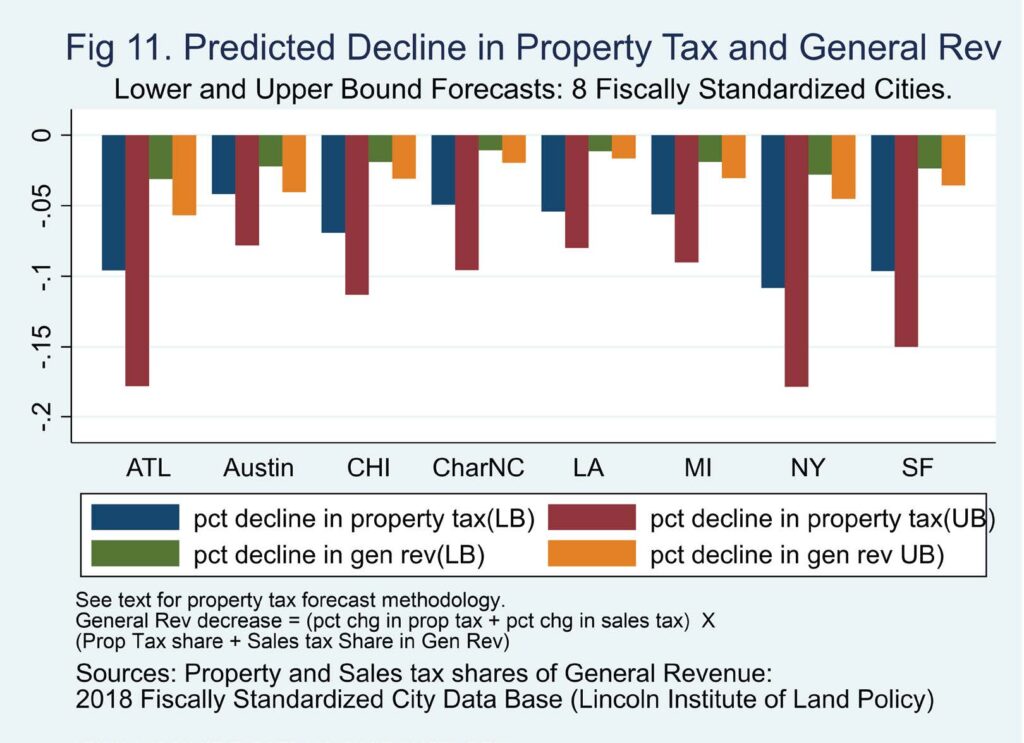

The Impact Of Work From Home On Commercial Property Values And The Property Tax In U S Cities Itep

Tax Rates Which County In Your State Has The Highest Tax Burden

The Impact Of Work From Home On Commercial Property Values And The Property Tax In U S Cities Itep

San Francisco Adopts Major Changes To Business Taxes 2019 Articles Resources Cla Cliftonlarsonallen

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

California Sales Tax Small Business Guide Truic

At What Income Level Does The Marriage Penalty Tax Kick In

In Housing Market Gone Nuts Condo Prices Sag In San Francisco Bay Area Hover In 3 Year Range In New York Rise At Half Speed In Los Angeles Wolf Street

Why Households Need 300 000 To Live A Middle Class Lifestyle

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

California State Sales Tax 2018 What You Need To Know Taxjar

Is Tax Higher In New York Than In California Quora

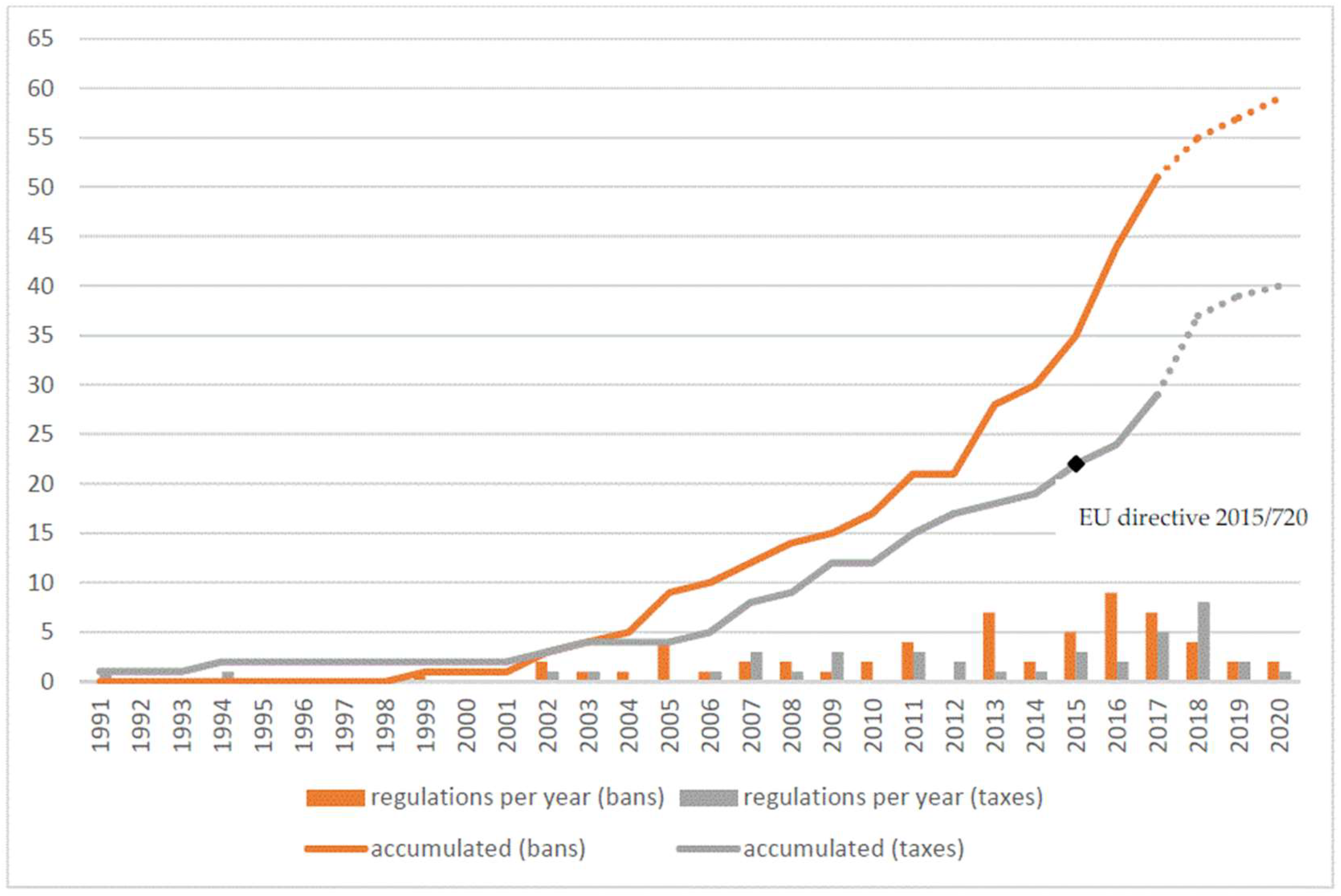

Sustainability Free Full Text Developing Countries In The Lead What Drives The Diffusion Of Plastic Bag Policies Html

Migration To Low Tax Metros Is Accelerating As More People Looked To Leave Expensive Coastal Areas In The Second Quarter Low Taxes Migrations Two By Two

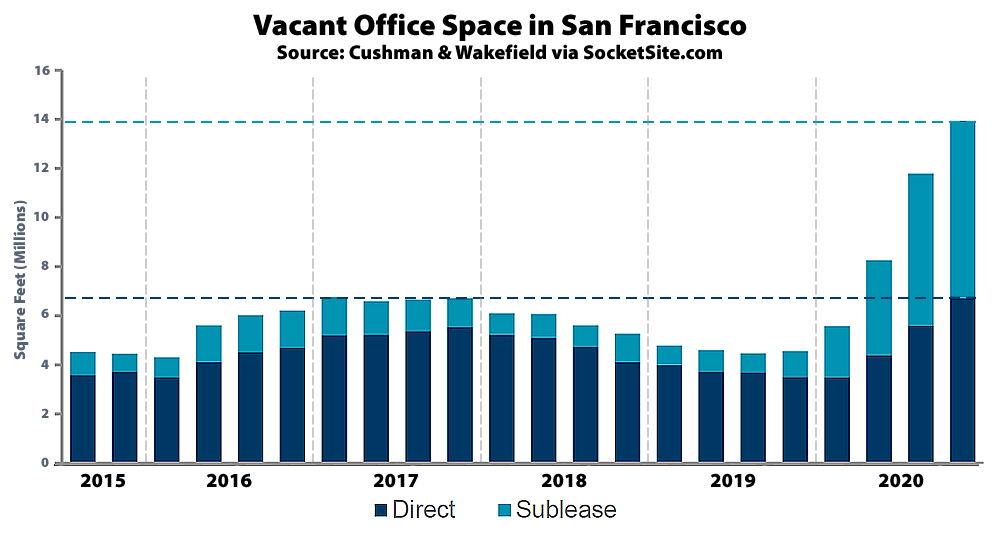

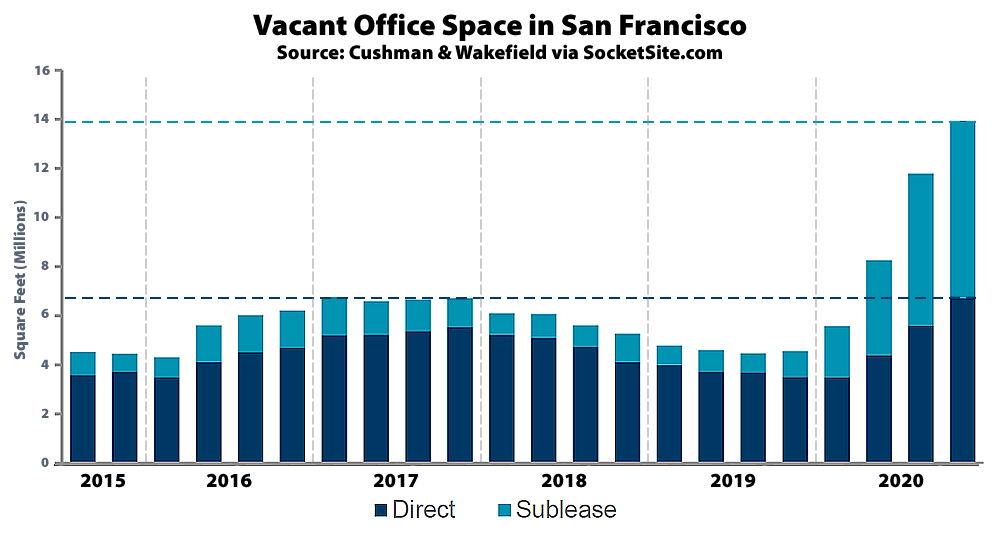

Nearly 14 Million Square Feet Of Vacant Office Space In S F

How Do State And Local Sales Taxes Work Tax Policy Center

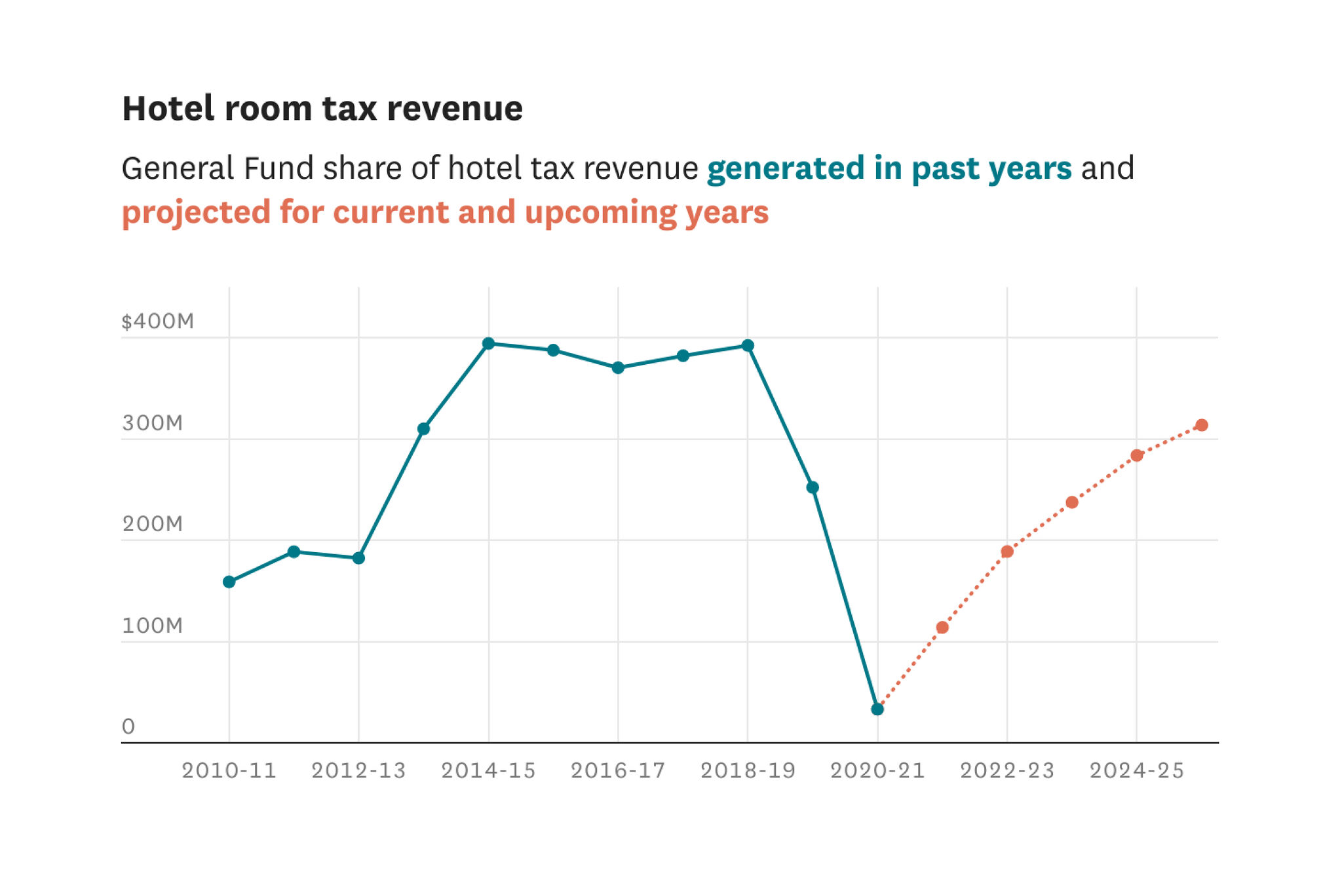

San Francisco Is Projected To Have 6 3 Billion To Spend In 2022 2023 Here S How The Pandemic Is Impacting Those Numbers